Introduction:

Each book in the Rich Dad series is an interesting learning experience for those who are interested & serious about Money, Finance, Investing & most important coming future. So we try to understand Rich Dad Poor Dad book summary.

In the book ‘Rich Dad Poor Dad’ there was as difference as chalk & cheese between what author Robert Kiyosaki learned from both his dads (Poor Dad was his own dad & Rich Dad was his father’s friend). Rich Dad gave the opposite advice to the advice given by Poor Dad.

In this blog, I will try to share 3 Important Learnings from Robert Kiyosaki book ‘Rich Dad Poor Dad’.

When Robert Kiyosaki was 9 years old, one day he was walking in the beach with his Rich Dad, then his Rich Dad showed him a big posh bungalow and asked him to buy this bungalow. Robert was shocked because in those days his Rich Dad was not actually that rich and Rich Dad‘s income was less than Poor Dad‘s. Then Robert asked to Rich Dad how can you buy this bungalow when you have not that much money to buy this. Then Rich Dad said I cannot buy but my business can buy it.

Here we can learn our first learning.

Rich Dad Poor Dad book summary Learning #1

Because when you withdraw more profit, first you will pay more tax, then you will keep the remaining money in such a place where the money will not be able to grow properly like, savings account or fixed deposit.

Every successful company reinvests its profits, from Elon Musk‘s Tesla to Mukesh Ambani‘s Reliance all stories are same. This company pays minimum dividend and reinvests its entire amount either in its own business or in acquiring another company. That is why the share price of these companies has increased many times in the last few years. When you work and the salary you get is already tax deducted. You put the remaining salary in savings account or fixed deposit which gives you 7-8% interest, and India’s inflation on average is 6-7%. If you think that this 8% that you are earning from the bank then you are kidding yourself.

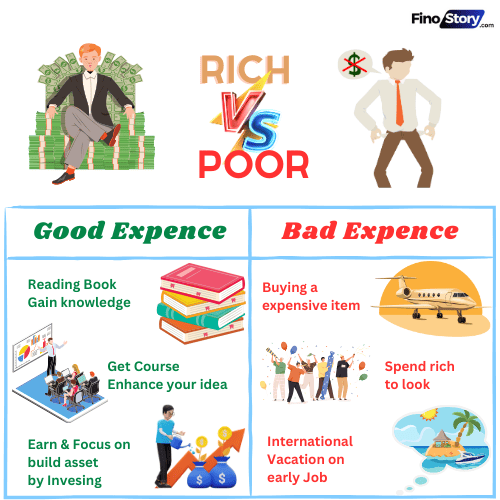

And increasing your expenditure means that you should spend it in the right places. One day his tax advisor shows to Robert something interesting that some mistakes of being Rich and Poor.

Can be understood in a chart as shown below…

What we learn from this:

Author Robert‘s Rich Dad talks about expenses that will help you become prosperous, that will help you in tax saving that will keep you Rich forever. Like paying for your education, paying for books, any course which will help in your progress and purchasing such assets will always maintain your future cash flow or hire an employee who will do your work autonomously so that you can get more free time to handle other work.

Rich Dad Poor Dad book summary Learning #2

#Acquire Education, Experience & Excess Cash

According to Robert Kiyosaki, if you want to become Rich and stay Rich then you will have to Acquire 3 things. These 3 things are Education, Experience, Excess Cash. With the help of these 3 things, you can take advantage of such an opportunity that you can become rich. These opportunities are always available and will be. You should know how to find these and how to apply.

Education

Author Robert Kiyosaki‘s Rich Dad is not talking about school or college degree here, he is talking about Financial Knowledge. People often say that when they get a lot of money then they will invest, but the truth is that if such people get a lot of money, then they become poor in a few years because they start handling the new money with their old habits. Used to be, not everyone win lottery in real life.

Rich Dad is talking about this knowledge here, do you know how to run a business in real life or not? How to start a business? How do you run a business? And the most important education is how to read the company’s financial statements like balance sheet, income report etc. If you invest without education then it is called gambling.

Experience

Robert’s rich dad used to give him blank financial statements in his childhood and used to ask him to write the asset side column himself, so that he would get experience. Rich Dad knew that to become a good investor or rich, it is necessary to have experience or to do business practically. Robert used to add assets in that black asset column and tried to learn it again and again, because his rich dad wanted him to start learning early in real life.

Excess Cash

You do not need to worry too much about Excess Cash because if you have proper education and experience, the money will automatically follow you and when you have that much cash, you will already know where to invest it so that it can grow further and give you a financial security.

When people finish their college education, they look for jobs not opportunity, look for job security not for financial security and all problems are stated here in our society. That’s why less than 10% of the world’s people own more than 90% of the world’s money because their education, experience and extra cash always grows with them.

Rich Dad Poor Dad book summary Learning #3

#Investing is not Risky

Investing is not risky because you do not know much about investing, that is why it seems risky to you. Why does Robert tell us to become an inside investor? Author Robert is suggesting us that investing will not be risky if you invest in your business, if you buy a stock, consider it as your company and invest and do as much research as you do while buying a house or purchasing any big thing. And after doing so much research, you get the inside information, similarly if you are investing in any asset then you should have complete inside information about it.

I hope everyone enjoyed this blog, please leave value comment share to others. Thank You.